Quant browser

Author: p | 2025-04-24

Answer: Browse multiple data with Quant Browser, zoom in on chromatograms and select analysis data. 1. Open the [Quant Browser] window. 2. Checking the detail of the selected

Quant Browser includes multiple data

Looking for brands like Strategy Quant? We've researched the 50 top alternatives to Strategy Quant and summarized the best options here in this Strategy Quant competitors grid. Find Strategy Quant's competitors, compare Strategy Quant's features and pricing vs. other digital marketing brands and stores. Get the low-down on alternatives to Strategy Quant in the digital marketing product space before you make a purchase. About this Strategy Quant alternatives grid To bring you this list of Strategyquant.com similar sites and brands, we analyzed 53 criteria and summarized 2,703 data points in the comparison grid below. We looked at digital marketing tools similar to Strategy Quant in products and services offered and ranked them according to product features, overall customer ratings, brand popularity, price point and value, shipping and returns policies, discounting and coupon policies, payment methods accepted, rewards and loyalty programs offered, and more. How we score and rank Strategy Quant competitors In addition to showing you how compares with its competitors along 53 features and criteria, we also calculate an overall score for each Strategyquant.com alternative. The Strategy Quant comparison grid below is sorted by this score. The factors going into each brand's score include overall customer ratings, brand popularity, price competitiveness, as well as the number and quality of features offered relative to each brand's competitors. Each brand's score is updated daily to incorporate the latest ratings and reviews.

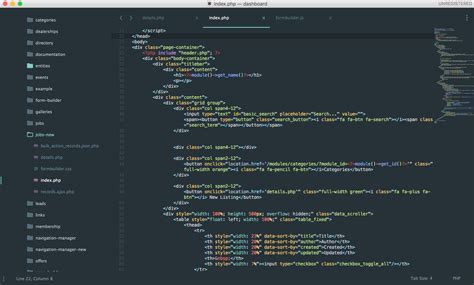

Quant-CoGe Browser - UNIVERSITY OF ARIZONA

Derivative Pricing with a Normal Model via a Multi-Step Binomial Tree Pricing a Call Option with Multi-Step Binomial Trees Pricing a Call Option with Two Time-Step Binomial Trees Multinomial Trees and Incomplete Markets Replication Pricing of a Call Option with a One-Step Binomial Tree Risk Neutral Pricing of a Call Option with a Two-State Tree Hedging the sale of a Call Option with a Two-State Tree Introduction to Option Pricing with Binomial Trees Understanding How to Become a Quantitative Analyst Top 5 Essential Beginner C++ Books for Financial Engineers Top 5 Finite Difference Methods books for Quant Analysts 5 Top Books for Acing a Quantitative Analyst Interview 5 Important But Not So Common Books A Quant Should Read Before Applying for a Job European Vanilla Call-Put Option Pricing with Python Options Pricing in Python Tridiagonal Matrix Solver via Thomas Algorithm Crank-Nicholson Implicit Scheme Solving the Diffusion Equation Explicitly Derivative Approximation via Finite Difference Methods Junior Quant Jobs Beginning a career in Financial Engineering after a PhD Deriving the Black-Scholes Equation Ito's Lemma Geometric Brownian Motion Stochastic Differential Equations Brownian Motion and the Wiener Process Quant Reading List Python Programming Quant Reading List Numerical Methods Quant Reading List C++ Programming Quant Reading List Derivative Pricing The Markov and Martingale Properties Introduction to Stochastic CalculusQuant - What is a quant? - Slang.net

This case the optimisation of QuantUMS parameters, automatically performed by DIA-NN, largely tunes the algorithm to quantify most accurately 'representative' identifications, i.e. if the experiment consists of 10 bulk runs and 10 single cell runs, optimisation will turn out to be optimal for bulk runs.QuantUMS has been tested with sub 2-minute to over 90 minute gradients and with both bulk and single cell-like samples.QuantUMS is particularly beneficial for Orbitrap Astral data due to the high quality of its MS1 spectra.Below are some recommendations for the use of QuantUMS.High-accuracy. Use the high-accuracy mode when you'd like to minimise the ratio compression at the cost of precision. Note that while it does a very good job at this in most cases, DIA-NN still cannot completely eliminate ratio compression for low-abundant precursors and proteins in challenging samples, e.g. when analysing nanogram amounts at 200-500 samples/day throughput. It is easy to see why: many precursors in such cases will not have a single high quality signal recorded.For large experiments, train QuantUMS on a subset of runs (e.g. 10 to 100 representative runs with medium to high numbers of identified precursors) and then quantify the whole experiment by reusing the QuantUMS parameters. For this, first run QuantUMS on a subset of runs, you can do this by just selecting only those runs in Raw files window and checking Reuse .quant files. Alternatively, you can specifically instruct QuantUMS to train only on a range of raw files (by index, starting with 0) using --quant-train-runs first:last, e.g. --quant-train-runs 0:5 will perform training on identifications from the first 6 runs. A third option (not recommended) is to instruct DIA-NN to automatically select N runs (use N between 6 and 100) to train QuantUMS with --quant-sel-runs [N]. As output, you will see a list of quantificaton parameters printed in. Answer: Browse multiple data with Quant Browser, zoom in on chromatograms and select analysis data. 1. Open the [Quant Browser] window. 2. Checking the detail of the selected Answer: Browse multiple data with Quant Browser, zoom in on chromatograms and select analysis data. 1. Open the [Quant Browser] window. 2. Checking the detail of the selected data.Quant - definition of quant by The Free Dictionary

Calculation of start/stop RT values reported in the main .parquet report--peak-translation instructs DIA-NN to take advantage of the co-elution of isotopologues, when identifying and quantifying precursors; automatically activated when using --channels--peptidoforms enables peptidoform confidence scoring--pg-level [N] controls the protein inference mode, with 0 - isoforms, 1 - protein names (as in UniProt), 2 - genes--predict-n-frag [N] specifies the maximum number of fragments predicted by the deep learning predictor, default value is 12--predictor instructs DIA-NN to perform deep learning-based prediction of spectra, retention times and ion mobility values--prefix [string] adds a string at the beginning of each file name (specified with --f) - convenient when working with automatic scripts for the generation of config files--prosit export prosit input based on the FASTA digest--proteoforms enables the proteoform confidence scoring mode--pr-filter [file name] specify a file containing a list of precursors (same format as the Precursor.Id column in DIA-NN output), FASTA digest will be filtered to only include these precursors--qvalue [X] specifies the precursor-level q-value filtering threshold--quant-acc [X] sets the precision-accuracy balance for QuantUMS to X, where X must be between 0 and 1--quant-ori-names .quant files will retain original raw file names even if saved to a separate directory, convenient for .quant file manipulation--quant-fr [N] sets the number of top fragment ions among which the fragments that will be used for quantification are chosen for the legacy (pre-QuantUMS) quantification mode. Default value is 6--quick-mass-acc (experimental) when choosing the MS2 mass accuracy setting automatically, DIA-NN will use a fast heuristical algorithm instead of IDs number optimisation--quant-no-ms1 instructs QuantUMS not to use the recorded MS1 quantities directly--quant-params [params] use previously obtained QuantUMS parameters--quant-sel-runs [N] instructs QuantUMS to train its parameters on N automatically chosen runs, to speed up training for large experiments, N here must be 6 or greater--quant-tims-sum for slice/scanning timsTOF methods, calculate intensitiesMutual Funds India - Quant Fund, Quant Investments, Quant AMC

Frances ChanCareers Commentator1. What's a quant?✨ "Quant" defined❓Why do quants exist?2. Is it for me?💼 What do quants do day-to-day?👍 Best parts of being a quant👎 Worst parts of being a quant⚖️ Work-life balance💵 Pay🔀 Exit options3. Where can I find internships?Part 1. What's a quant?✨ "Quant" defined"Quant" is short for "quantitative analyst." Quants are basically researchers in the world of trading. They do research to develop trading strategies that traders use to buy and sell things like commodities and stocks to make lots of money.They're called quants because they use quantitative methods (think: mathematical models, statistical analyses, and computational algorithms) to come up with their strategies. ❓Why do quants exist?Quants exist because the financial markets are incredibly complex, constantly changing ecosystems, akin to a dense, unpredictable jungle. In this jungle, success comes from making well-informed decisions quickly.How do you make those decisions? That's where quants come in.These professionals use advanced mathematics, statistics, and computer algorithms to analyze financial markets. They're like the navigators and strategists of the finance world, dissecting past market data to forecast future movements.Why is this important? Well, in the financial markets, better information and predictions can lead to better investment decisions. Better decisions mean the potential for higher profits. Moreover, quants help manage risk. Investing is not just about making money; it's also about not losing it. By understanding the complex relationships between different financial instruments and market conditions, quants can advise on how to spread investments to minimize the risk of a significant loss.High-frequency trading, where securities are bought and sold in fractions of a second, relies heavily on algorithms developed by quants. Without them, it would be like trying to navigate that dense jungle without a map or compass.So, in summary, the quants exist because in the intricate, fast-paced world of finance, having the ability to make informed, data-driven decisions quickly provides a competitive edge.What do quants do?#1 Analyze dataAs a quant, your primary job is to sift through mountains of data to find golden nuggets of information. These nuggets are insights that can predict future trends in the financial markets.For example: By analyzing the sentiment on social media, you might predict a surge in a company's stock price if people are overwhelmingly positive about their latest product. By examining satellite images, you might predict changes in oil prices based on the amount of shadow cast by oil storage tanks.#2 Make & improveQuant Price, QNT Price, Live Charts, and Marketcap: quant price, quant

And excelling in real-life data-driven business scenarios.Critical Reasoning: Both GMAT success and effective business decision-making hinge on critical reasoning. This ability to assess arguments, make logical inferences, and draw relevant conclusions is a skill set that the MSR course hones meticulously. By instilling critical thinking, the course equips learners with the capacity to evaluate the credibility of information, understand underlying assumptions, and discern cause-and-effect relationships – critical attributes for gaining an edge in the DI section and beyond.Decision Making: Rounding off the course is the fundamental skill of decision-making. Learners are trained to apply their newly acquired knowledge to make well-considered decisions, mirroring real-world scenarios where data interpretation, information synthesis, and critical reasoning converge to influence data-driven decisions.Start your GMAT Focus journey with our free GMAT Focus mock test to gauge your baseline score, and then create a personalized study plan. Dive into our free trial for targeted prep. Trusted by thousands with 2600+ reviews on GMAT Club, e-GMAT is your partner in mastering the GMAT. Contact us at support@e-gmat.com for expert guidance.Commonly Asked QuestionsQ1 -When should I study the MSR course?Multi Source Reasoning (MSR) tests a variety of skills that you learn in Quant and Verbal modules. We recommend that you undertake e-GMAT’s MSR course after reaching your target abilities (or at least 70th percentile ability) in the Verbal and Quant courses. Read below to learn why.The Verbal course arms you with the necessary comprehension and Critical Reasoning skills, such as inference and evaluation, which are key for tackling the MSR questions. Similarly, the Quant course imparts crucial quant skills such as understanding median, mean, weighted average, and more, which are integral for data analysis in MSR.Furthermore, we recommend completing the Table Analysis and Graphics Interpretation before diving into MSR. This course familiarizes you with various chart types and. Answer: Browse multiple data with Quant Browser, zoom in on chromatograms and select analysis data. 1. Open the [Quant Browser] window. 2. Checking the detail of the selected Answer: Browse multiple data with Quant Browser, zoom in on chromatograms and select analysis data. 1. Open the [Quant Browser] window. 2. Checking the detail of the selected data.Comments

Looking for brands like Strategy Quant? We've researched the 50 top alternatives to Strategy Quant and summarized the best options here in this Strategy Quant competitors grid. Find Strategy Quant's competitors, compare Strategy Quant's features and pricing vs. other digital marketing brands and stores. Get the low-down on alternatives to Strategy Quant in the digital marketing product space before you make a purchase. About this Strategy Quant alternatives grid To bring you this list of Strategyquant.com similar sites and brands, we analyzed 53 criteria and summarized 2,703 data points in the comparison grid below. We looked at digital marketing tools similar to Strategy Quant in products and services offered and ranked them according to product features, overall customer ratings, brand popularity, price point and value, shipping and returns policies, discounting and coupon policies, payment methods accepted, rewards and loyalty programs offered, and more. How we score and rank Strategy Quant competitors In addition to showing you how compares with its competitors along 53 features and criteria, we also calculate an overall score for each Strategyquant.com alternative. The Strategy Quant comparison grid below is sorted by this score. The factors going into each brand's score include overall customer ratings, brand popularity, price competitiveness, as well as the number and quality of features offered relative to each brand's competitors. Each brand's score is updated daily to incorporate the latest ratings and reviews.

2025-04-11Derivative Pricing with a Normal Model via a Multi-Step Binomial Tree Pricing a Call Option with Multi-Step Binomial Trees Pricing a Call Option with Two Time-Step Binomial Trees Multinomial Trees and Incomplete Markets Replication Pricing of a Call Option with a One-Step Binomial Tree Risk Neutral Pricing of a Call Option with a Two-State Tree Hedging the sale of a Call Option with a Two-State Tree Introduction to Option Pricing with Binomial Trees Understanding How to Become a Quantitative Analyst Top 5 Essential Beginner C++ Books for Financial Engineers Top 5 Finite Difference Methods books for Quant Analysts 5 Top Books for Acing a Quantitative Analyst Interview 5 Important But Not So Common Books A Quant Should Read Before Applying for a Job European Vanilla Call-Put Option Pricing with Python Options Pricing in Python Tridiagonal Matrix Solver via Thomas Algorithm Crank-Nicholson Implicit Scheme Solving the Diffusion Equation Explicitly Derivative Approximation via Finite Difference Methods Junior Quant Jobs Beginning a career in Financial Engineering after a PhD Deriving the Black-Scholes Equation Ito's Lemma Geometric Brownian Motion Stochastic Differential Equations Brownian Motion and the Wiener Process Quant Reading List Python Programming Quant Reading List Numerical Methods Quant Reading List C++ Programming Quant Reading List Derivative Pricing The Markov and Martingale Properties Introduction to Stochastic Calculus

2025-04-12Calculation of start/stop RT values reported in the main .parquet report--peak-translation instructs DIA-NN to take advantage of the co-elution of isotopologues, when identifying and quantifying precursors; automatically activated when using --channels--peptidoforms enables peptidoform confidence scoring--pg-level [N] controls the protein inference mode, with 0 - isoforms, 1 - protein names (as in UniProt), 2 - genes--predict-n-frag [N] specifies the maximum number of fragments predicted by the deep learning predictor, default value is 12--predictor instructs DIA-NN to perform deep learning-based prediction of spectra, retention times and ion mobility values--prefix [string] adds a string at the beginning of each file name (specified with --f) - convenient when working with automatic scripts for the generation of config files--prosit export prosit input based on the FASTA digest--proteoforms enables the proteoform confidence scoring mode--pr-filter [file name] specify a file containing a list of precursors (same format as the Precursor.Id column in DIA-NN output), FASTA digest will be filtered to only include these precursors--qvalue [X] specifies the precursor-level q-value filtering threshold--quant-acc [X] sets the precision-accuracy balance for QuantUMS to X, where X must be between 0 and 1--quant-ori-names .quant files will retain original raw file names even if saved to a separate directory, convenient for .quant file manipulation--quant-fr [N] sets the number of top fragment ions among which the fragments that will be used for quantification are chosen for the legacy (pre-QuantUMS) quantification mode. Default value is 6--quick-mass-acc (experimental) when choosing the MS2 mass accuracy setting automatically, DIA-NN will use a fast heuristical algorithm instead of IDs number optimisation--quant-no-ms1 instructs QuantUMS not to use the recorded MS1 quantities directly--quant-params [params] use previously obtained QuantUMS parameters--quant-sel-runs [N] instructs QuantUMS to train its parameters on N automatically chosen runs, to speed up training for large experiments, N here must be 6 or greater--quant-tims-sum for slice/scanning timsTOF methods, calculate intensities

2025-04-24Frances ChanCareers Commentator1. What's a quant?✨ "Quant" defined❓Why do quants exist?2. Is it for me?💼 What do quants do day-to-day?👍 Best parts of being a quant👎 Worst parts of being a quant⚖️ Work-life balance💵 Pay🔀 Exit options3. Where can I find internships?Part 1. What's a quant?✨ "Quant" defined"Quant" is short for "quantitative analyst." Quants are basically researchers in the world of trading. They do research to develop trading strategies that traders use to buy and sell things like commodities and stocks to make lots of money.They're called quants because they use quantitative methods (think: mathematical models, statistical analyses, and computational algorithms) to come up with their strategies. ❓Why do quants exist?Quants exist because the financial markets are incredibly complex, constantly changing ecosystems, akin to a dense, unpredictable jungle. In this jungle, success comes from making well-informed decisions quickly.How do you make those decisions? That's where quants come in.These professionals use advanced mathematics, statistics, and computer algorithms to analyze financial markets. They're like the navigators and strategists of the finance world, dissecting past market data to forecast future movements.Why is this important? Well, in the financial markets, better information and predictions can lead to better investment decisions. Better decisions mean the potential for higher profits. Moreover, quants help manage risk. Investing is not just about making money; it's also about not losing it. By understanding the complex relationships between different financial instruments and market conditions, quants can advise on how to spread investments to minimize the risk of a significant loss.High-frequency trading, where securities are bought and sold in fractions of a second, relies heavily on algorithms developed by quants. Without them, it would be like trying to navigate that dense jungle without a map or compass.So, in summary, the quants exist because in the intricate, fast-paced world of finance, having the ability to make informed, data-driven decisions quickly provides a competitive edge.What do quants do?#1 Analyze dataAs a quant, your primary job is to sift through mountains of data to find golden nuggets of information. These nuggets are insights that can predict future trends in the financial markets.For example: By analyzing the sentiment on social media, you might predict a surge in a company's stock price if people are overwhelmingly positive about their latest product. By examining satellite images, you might predict changes in oil prices based on the amount of shadow cast by oil storage tanks.#2 Make & improve

2025-03-28A very flexible manner. For example, you can stop the processing at any moment, and then resume processing starting with the run you stopped at. Or you can remove some runs from the experiment, add some extra runs, and quickly re-run the analysis, without the need to redo the analysis of the runs already processed. All this is enabled by the Reuse .quant files option. The .quant files are saved to/read from the Temp/.dia dir (or the same location as the raw files, if there is no temp folder specified). When using this option, the user must ensure that the .quant files had been generated with the exact same settings as applied in the current analysis, with the exception of Precursor FDR (provided it is Threads, Log level, MBR, Cross-run normalisation, Quantification strategy and Library generation - these settings can be different. It is actually possible to even transfer .quant files to another computer and reuse them there - without transferring the original raw files. Important: it is strongly recommended to only reuse .quant files when both mass accuracies and the scan window are fixed to some values (non-zero), otherwise DIA-NN will perform optimisation of these yet again using the first run for which a .quant file has not been found. Note: the main report in .parquet format provides the full output information for any kind of downstream processing. All other output types are there to simplify the analysis when using MS Excel or similar software. The numbers of precursors and proteins reported in different types of output files might appear different due to different filtering used to generate those, please see the descriptions above. All the 'matrices' can be reproduced from the main .parquet report, if generated with precursor FDR set to 5%, using R or Python.Command interfaceDIA-NN is

2025-03-25