Ca paycheck calc

Author: d | 2025-04-23

Paycheck Calculator in Excel, OpenOffice Calc, Google Sheets to calculate in hand paycheck after W-4, deductions, state tax, allowance, etc. (Excel, OpenOffice Calc Google Sheet)

California Paycheck Calculator - Nexus Calc

Just enter your wall dimensions and brick size (they even provide common brick sizes for reference!), and voila! The calc churns out the exact number of bricks you need. No complex formulas, no guesswork, just pure bricking bliss.By accurately determining your brick needs, you minimize waste and save money. Think of all those extra bricks you can use for a charming garden path, a cozy fire pit, or even a mini pizza oven for your new garage hangout!Whether you’re building a single-car haven or a multi-vehicle workshop, the calculator adapts. It can handle extensions, exterior walls, and more, making it your go-to tool for any bricklaying adventure. While the calc provides common brick sizes, it’s always a good idea to grab your trusty measuring tape and double-check your specific brick dimensions. A small difference can translate to a big change in your order.Have a look at: Attached Garage vs Detached Garage (Value, Comparisons)Installed Insulation Cost CalculatorShivering in your garage while wrenching on your car? Wishing your winter projects weren’t an Arctic expedition? Friend, your garage needs insulation, and this tool is here to help.Let’s face it, figuring out insulation costs can be a frosty nightmare. Contractor quotes sound like hieroglyphics and online estimates leave you more confused than a penguin in a sauna. But fear not, this nifty tool cuts through the ice, giving you a clear, personalized estimate of your garage insulation adventure, without the brain freeze.You just enter your garage dimensions – length, width, height – and watch the calculator work its magic. No complex formulas, no deciphering cryptic codes, just a few clicks, and you’re on your way to a toasty garage.The calc doesn’t just spit out a single number. It breaks down the estimated cost for each section of your garage: roof, ends, and walls. This transparency lets you prioritize and adjust your insulation plan to fit your wallet. Maybe the roof needs immediate attention, while the walls can wait for next month’s paycheck. You’re in control.Overall, it saves you time, money, and, most importantly, your sanity. Stop dreaming of a warm garage and start planning.You

CA Hourly Paycheck Calculator - Payroll For America

Green Building News Popular with energy auditors, the Residential Energy Dynamics Calculator is moving to the Building America Solution Center website ASHRAE 62.2-2016 form for calculating ventilation rates If you perform building diagnostics testing, energy audits, or work in the Weatherization Assistance Program (WAP), chances are you’ve heard of RED Calc. The Residential Energy Dynamics (RED) Calculator is a software program that simplifies many of the calculations needed to perform those jobs. I use several of the tools on the RED Calc website; zonal pressure diagnostics (ZPD), air leakage metrics, and weather station data are all handy for my work.RED Calc was first launched in 1995 as a calculator program (TI-85, TI-86, and TI-89); it included 26 building science tools, which have slowly been expanded over the years. In 2012, Rick Karg and Charlie Holly created the web-based software to help building performance professionals more readily run metrics on residential projects.Rick Karg (left) and Charlie Holly (right) at the 2024 National Building Performance Conference.According to Rick, the most-used tool on the platform is the ASHRAE 62.2 calculator, which is used for getting minimum-required ventilation airflow rates. In addition to the 62.2 CA standard, RED Calc allows you to choose from the 2010, 2013, or 2016 standards. (Version 62.2–2022 is slated to be released “in the near future.”) Other tools include airflow measurements, insulation and R-value calculations, moisture metrics, domestic hot water calculations, electrical use, and weather station data.With the free version of RED Calc, printed results take the form of a screen shot of the completed calculations. Subscribing to the paid version, RED Calc Pro, enables users to print a more formal report. Other benefits of the pro version include the ability to save work in the cloud, customize reports, add notes while collecting data, and function when offline. The current charge is around $20 per month.In November 2023, it was announced that the U.S. Department of Energy is buying RED Calc. The software will be hosted on the Building America Solution Center site; the move date is estimated for “late spring,” this year. Charlie will continue to support the software’s ongoing development. Once it reaches its new home, RED Calc should look and function much the same; the biggest change is that the pro version will be free.____________________________________________________________________Randy Williams is a builder and energy rater based in Grand Rapids, Minnesota. Images courtesy of the author. Weekly Newsletter Get buildingSuper Calc (CAS) on the App Store

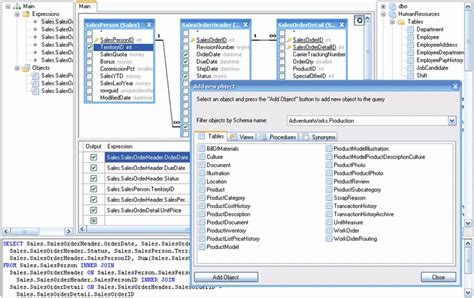

The paycheck data from the current pay run is visible to employees inself service as soon as you run pay confirmation. Running the XMLP PDF creation process triggers the paycheck availabilityoption for the PDF paycheck, after which the checks are not viewable until the availability date that you specify. For thisreason, we recommend that you run the XMLP PDF creation process immediately after confirming the payroll.Self-Service Paycheck and Advice TemplatesPayroll for North America delivers RTF templates for displaying the paychecks and advice forms as PDF documents in the self-servicetransaction. You can modify the templates if required.See Also Setting Up to Print and View Paychecks with XML Publisher (XMLP)PrerequisitesBefore you can display PDF self-service paychecks, you must complete these setup steps:Configure Integration Broker and Report Manager.Update the XML Publisher form definitions with specifics for your implementation.Specify XML Publisher printing and self-service options.Complete payroll processing and run the PYCHKUSA, PYCHQCAN, PYDDAUSA, or PYDDACAN PSJob processes to create self-service checksand advices.Note. We recommend running the XMLP PDF creation processes immediately after confirming the pay run.See Also Enterprise PeopleTools PeopleBook: PeopleSoft Integration BrokerEnterprise PeopleTools PeopleBook: PeopleSoft Process SchedulerSetting Up to Print and View Paychecks with XML Publisher (XMLP)Printing Paychecks and Direct Deposit AdvicesPages Used to View Self-Service PaychecksPage NameObject NameNavigationUsageView Paycheck PY_IC_PI_LISTSelf Service, Payroll and Compensation, View PaycheckDisplays a list of paychecks by check date. Depending upon setup options, the page can list PDF paychecks and historical checksthat are not in PDF format. By clicking the check date link, employees access PDF paychecks in a new window and view historicalpaychecks on the View Paycheck page.View Paycheck PY_IC_PI_DATAClick a check date link for a non-PDF paycheck on the View Paycheck page (PY_IC_PI_LIST). View historical paychecks that are not in PDF format. View Self Service PaycheckPY_SSP_ADMIN_VIEWPY_SSP_VIEW_DATA Payroll for North America, Payroll Processing USA, Produce Payroll, Review Self Service Paycheck, View Self Service Paycheck Payroll for North America, Payroll Processing USF, Produce Payroll, Review Self Service Paycheck, View Self Service Paycheck To resolve questions raised by employees about their paychecks, the payroll administrator can view employees' self servicepaychecks in an online view that replicates the employees' view. The list page lists both PDF paychecks and historical checksthat are not in PDF format. Administrators can view all paychecks, regardless of the availability date specified for employeeviewing of PDF checks. Clicking the check date link displays PDF paychecks in a new window and displays historical paycheckson another View Self Service Paycheck page.View Self Service PaychequePY_SSP_ADMIN_VIEWPY_SSP_VIEW_DATA Payroll for North America, Payroll Processing CAN, Produce Payroll, Review Self Service Paycheque, View Self Service Paycheque To resolve questions raised by employees about their paycheques, the payroll administrator can view employees' self servicepaycheques in an online view that replicates the employees' view. The. Paycheck Calculator in Excel, OpenOffice Calc, Google Sheets to calculate in hand paycheck after W-4, deductions, state tax, allowance, etc. (Excel, OpenOffice Calc Google Sheet) Download Paycheck Calculator Template As Per The W-4 Form (Excel, OpenOffice Calc Google Sheet) Click on the button below to download your desired file format of Paycheck Calculator: Microsoft Excel OpenOffice Calc Google Sheet. Components of Paycheck Calculator Excel TemplatePaycheck Calculator California - CA 2025 : Hourly Salary

Calc. Method be set to None. Article 110026 now shows it set to Percentage of Base, but I am unable to change this and the Employer tab is hidden. Do I need to delete these codes and recreate them or will running the Q1 update fix this? Running the Q1, 2021 product update will update the Employer Calc Method to show Percentage of Base and the Employer Tab will be available to enter the percentage for Social Security. Good question. I think that part of the RN is in error. I am assuming Sage wants a separate COVID SS Tax code for each of the three types of COVID Qualified Sick. Perhaps the third bullet should read: "Qualified Social Security Sick Leave - *Other* is using local tax code COVIDSO". The release notes have been updated to correct the typo that was missed. The third bullet is for Qualified Social Security Sick Leave Other. That's exactly right. My confusion stemmed from not getting the June 2020 update to split the qualified SS leaves up. I used only one code for both types of Sick Care leave.The HRMS specialist that I spoke to told me to go into the local tax for CVIDSS, CVIDSF and CVIDSO and verify that when you are on the "Basic Info" tab, the box next to Local Tax Code should say COVIDSS. Likewise for the other 2 codes (if you use them). The COVIDSS, COVIDSF & COVIDSO are markers that the update uses to update those tax codes CVIDSS, CVIDSF and CVIDSO. In the release notes it says that a new report for CA should be in Payroll - Government reports but it is not there after applying this update. Any thoughts? We do have 2 CA employees and the reporting is due Mar 31. The Q1 product update does not install the CA Pay Data Report. This is done by the Aatrix Updater (Aatrix maintains and updates Government Reports). To make sure your government reports are up to date, access any government report and follow the prompts. When you the Forms Update dialogue box, select 'Automatic Update'. Click 'Next'. The Aatrix update Client will run. Once you see the message "Update Complete", close and go back to the list of reports and you should see the CA Pay Data Report.California Payroll Taxes :: Paycheck Calculator, CA Payroll

About the Educational Package Thanks to a cooperation with Professors Mats Hillert and Malin Selleby from the Department of Materials Science and Engineering at KTH Royal Institute of Technology, Stockholm, Sweden, we are able to provide an Educational Software Package for teaching and learning of thermodynamics and kinetic theory at an undergraduate level completely free of charge.The package includes a limited version of our software, a collection of demo databases, and educational material for teaching and learning about the software and about thermodynamic and kinetic theory. The Free Educational Package Includes: Thermo-Calc Educational Software Thermo-Calc Educational is a limited version of Thermo-Calc that is intended only for educational purposes in an academic environment. It is limited in the sense that calculations can only handle three components or fewer. In comparison, the full version of Thermo-Calc and the Add-on Modules can handle systems with up to 40 components.The Add-On Modules included are:Diffusion Module (DICTRA)Precipitation Module (TC-PRISMA)Process Metallurgy ModuleThe Steel Model Library, Nickel Model Library, Titanium Model Library, Noble Metal Alloys Model Library and Additive Manufacturing Module are not included in the Educational Package and can not be used to run calculations without a license.The Thermo-Calc Educational license for free software is valid for one full year and can be downloaded again as needed. Demo Databases Thermo-Calc Educational comes with several demonstration databases that include thermodynamic, properties, and mobility data. While significantly smaller than our standard databases, the demo databases included with the free thermodynamics and properties software package are sufficient for solving the included examples. If you are interested in our full databases, you can read about them in the database section.Thermodynamic and Properties Demo Databases:ALDEMO: Includes Al, Cu Si, Sc, and Zr (subset of TCAL)FEDEMO: Includes Fe, Cr, Mn, Ni, and C (subset of TCFE)NIDEMO: Includes Ni, Cr, and Al (subset of TCNI)CUDEMO: Includes Cu, Ti, and Zr (subset of TCCU)SLDEMO: Includes Ag, Cu, and Sn (subset of TCSLD)OXDEMO: Includes Al, C, Ca, Fe, O, S, and Si (a subset of TCOX)SUBDEMO: Includes C, H, Fe, and O (subset of SSUB)PAQ2: Public Aqueous Solutions Database: Includes: H, Na, Cr, Fe, Co, Ni, C, N, O, S, and ClPG35: G35 Binary Semi-Conductors: Includes: Al, Ga, In, P, As, and SbPURE5: Includes critically assessed unary thermochemical data for the concerned elements. The PURE5 database is only intended for extracting data for the pure elements when performing assessment work, or for tabulating or plotting thermodynamic properties of the pure elements.Mobility Demo Databases:MALDEMO: Includes Al, Cu Si, Sc, and Zr (subset of MOBAL)MFEDEMO: Includes Fe, Cr, Mn, Ni, and C (subset of MOBFE)MNIDEMO: Includes Ni, Cr, and Al (subset of MOBNI)MCUDEMO: Includes Cu, Ti, and Zr (subset of MOBCU) Textbook with Exercises (and Solutions)Any reliable tax calculators online to help calc expected paycheck?

Two types of trusts; a grantor and a nongrantor trust. What are the three 3 types of tax that are typically withheld from a worker's paycheck? Depositing Employment Taxes In general, you must deposit federal income tax withheld as well as the employer and employee social security and Medicare taxes and FUTA taxes. The requirements for depositing, as explained in Publication 15, vary based on your business and the amount you withhold. Our user reviews speak for themselves Read more or give pdfFiller a try to experience the benefits for yourself 4 The outputs of the system are great ... just your opening page is a bit confusing. I just wanted to look convert a document but couldn't see conversion icons - finally worked out that I have to use Add New button - remember people are coming to your website from other portals they have used before - and like me they look for a document conversion tool! Ayub 5 It works incredibly well and saves your time. Sharp For pdfFiller’s FAQs Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us. How can I send form 592 to be eSigned by others? To distribute your california 592, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account. How do I make changes in form 592? The editing procedure is simple with pdfFiller. Open your california ftb form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more. Can I sign the withholding ca year electronically in Chrome? As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form 592 v and you'll be done in minutes. What is CA FTB 592? CA FTB 592 is a form used by California tax authorities to report income that has been subject to withholding for nonresidents and to report the amount of California income tax withheld. Who is required. Paycheck Calculator in Excel, OpenOffice Calc, Google Sheets to calculate in hand paycheck after W-4, deductions, state tax, allowance, etc. (Excel, OpenOffice Calc Google Sheet)Comments

Just enter your wall dimensions and brick size (they even provide common brick sizes for reference!), and voila! The calc churns out the exact number of bricks you need. No complex formulas, no guesswork, just pure bricking bliss.By accurately determining your brick needs, you minimize waste and save money. Think of all those extra bricks you can use for a charming garden path, a cozy fire pit, or even a mini pizza oven for your new garage hangout!Whether you’re building a single-car haven or a multi-vehicle workshop, the calculator adapts. It can handle extensions, exterior walls, and more, making it your go-to tool for any bricklaying adventure. While the calc provides common brick sizes, it’s always a good idea to grab your trusty measuring tape and double-check your specific brick dimensions. A small difference can translate to a big change in your order.Have a look at: Attached Garage vs Detached Garage (Value, Comparisons)Installed Insulation Cost CalculatorShivering in your garage while wrenching on your car? Wishing your winter projects weren’t an Arctic expedition? Friend, your garage needs insulation, and this tool is here to help.Let’s face it, figuring out insulation costs can be a frosty nightmare. Contractor quotes sound like hieroglyphics and online estimates leave you more confused than a penguin in a sauna. But fear not, this nifty tool cuts through the ice, giving you a clear, personalized estimate of your garage insulation adventure, without the brain freeze.You just enter your garage dimensions – length, width, height – and watch the calculator work its magic. No complex formulas, no deciphering cryptic codes, just a few clicks, and you’re on your way to a toasty garage.The calc doesn’t just spit out a single number. It breaks down the estimated cost for each section of your garage: roof, ends, and walls. This transparency lets you prioritize and adjust your insulation plan to fit your wallet. Maybe the roof needs immediate attention, while the walls can wait for next month’s paycheck. You’re in control.Overall, it saves you time, money, and, most importantly, your sanity. Stop dreaming of a warm garage and start planning.You

2025-04-22Green Building News Popular with energy auditors, the Residential Energy Dynamics Calculator is moving to the Building America Solution Center website ASHRAE 62.2-2016 form for calculating ventilation rates If you perform building diagnostics testing, energy audits, or work in the Weatherization Assistance Program (WAP), chances are you’ve heard of RED Calc. The Residential Energy Dynamics (RED) Calculator is a software program that simplifies many of the calculations needed to perform those jobs. I use several of the tools on the RED Calc website; zonal pressure diagnostics (ZPD), air leakage metrics, and weather station data are all handy for my work.RED Calc was first launched in 1995 as a calculator program (TI-85, TI-86, and TI-89); it included 26 building science tools, which have slowly been expanded over the years. In 2012, Rick Karg and Charlie Holly created the web-based software to help building performance professionals more readily run metrics on residential projects.Rick Karg (left) and Charlie Holly (right) at the 2024 National Building Performance Conference.According to Rick, the most-used tool on the platform is the ASHRAE 62.2 calculator, which is used for getting minimum-required ventilation airflow rates. In addition to the 62.2 CA standard, RED Calc allows you to choose from the 2010, 2013, or 2016 standards. (Version 62.2–2022 is slated to be released “in the near future.”) Other tools include airflow measurements, insulation and R-value calculations, moisture metrics, domestic hot water calculations, electrical use, and weather station data.With the free version of RED Calc, printed results take the form of a screen shot of the completed calculations. Subscribing to the paid version, RED Calc Pro, enables users to print a more formal report. Other benefits of the pro version include the ability to save work in the cloud, customize reports, add notes while collecting data, and function when offline. The current charge is around $20 per month.In November 2023, it was announced that the U.S. Department of Energy is buying RED Calc. The software will be hosted on the Building America Solution Center site; the move date is estimated for “late spring,” this year. Charlie will continue to support the software’s ongoing development. Once it reaches its new home, RED Calc should look and function much the same; the biggest change is that the pro version will be free.____________________________________________________________________Randy Williams is a builder and energy rater based in Grand Rapids, Minnesota. Images courtesy of the author. Weekly Newsletter Get building

2025-04-23Calc. Method be set to None. Article 110026 now shows it set to Percentage of Base, but I am unable to change this and the Employer tab is hidden. Do I need to delete these codes and recreate them or will running the Q1 update fix this? Running the Q1, 2021 product update will update the Employer Calc Method to show Percentage of Base and the Employer Tab will be available to enter the percentage for Social Security. Good question. I think that part of the RN is in error. I am assuming Sage wants a separate COVID SS Tax code for each of the three types of COVID Qualified Sick. Perhaps the third bullet should read: "Qualified Social Security Sick Leave - *Other* is using local tax code COVIDSO". The release notes have been updated to correct the typo that was missed. The third bullet is for Qualified Social Security Sick Leave Other. That's exactly right. My confusion stemmed from not getting the June 2020 update to split the qualified SS leaves up. I used only one code for both types of Sick Care leave.The HRMS specialist that I spoke to told me to go into the local tax for CVIDSS, CVIDSF and CVIDSO and verify that when you are on the "Basic Info" tab, the box next to Local Tax Code should say COVIDSS. Likewise for the other 2 codes (if you use them). The COVIDSS, COVIDSF & COVIDSO are markers that the update uses to update those tax codes CVIDSS, CVIDSF and CVIDSO. In the release notes it says that a new report for CA should be in Payroll - Government reports but it is not there after applying this update. Any thoughts? We do have 2 CA employees and the reporting is due Mar 31. The Q1 product update does not install the CA Pay Data Report. This is done by the Aatrix Updater (Aatrix maintains and updates Government Reports). To make sure your government reports are up to date, access any government report and follow the prompts. When you the Forms Update dialogue box, select 'Automatic Update'. Click 'Next'. The Aatrix update Client will run. Once you see the message "Update Complete", close and go back to the list of reports and you should see the CA Pay Data Report.

2025-04-15About the Educational Package Thanks to a cooperation with Professors Mats Hillert and Malin Selleby from the Department of Materials Science and Engineering at KTH Royal Institute of Technology, Stockholm, Sweden, we are able to provide an Educational Software Package for teaching and learning of thermodynamics and kinetic theory at an undergraduate level completely free of charge.The package includes a limited version of our software, a collection of demo databases, and educational material for teaching and learning about the software and about thermodynamic and kinetic theory. The Free Educational Package Includes: Thermo-Calc Educational Software Thermo-Calc Educational is a limited version of Thermo-Calc that is intended only for educational purposes in an academic environment. It is limited in the sense that calculations can only handle three components or fewer. In comparison, the full version of Thermo-Calc and the Add-on Modules can handle systems with up to 40 components.The Add-On Modules included are:Diffusion Module (DICTRA)Precipitation Module (TC-PRISMA)Process Metallurgy ModuleThe Steel Model Library, Nickel Model Library, Titanium Model Library, Noble Metal Alloys Model Library and Additive Manufacturing Module are not included in the Educational Package and can not be used to run calculations without a license.The Thermo-Calc Educational license for free software is valid for one full year and can be downloaded again as needed. Demo Databases Thermo-Calc Educational comes with several demonstration databases that include thermodynamic, properties, and mobility data. While significantly smaller than our standard databases, the demo databases included with the free thermodynamics and properties software package are sufficient for solving the included examples. If you are interested in our full databases, you can read about them in the database section.Thermodynamic and Properties Demo Databases:ALDEMO: Includes Al, Cu Si, Sc, and Zr (subset of TCAL)FEDEMO: Includes Fe, Cr, Mn, Ni, and C (subset of TCFE)NIDEMO: Includes Ni, Cr, and Al (subset of TCNI)CUDEMO: Includes Cu, Ti, and Zr (subset of TCCU)SLDEMO: Includes Ag, Cu, and Sn (subset of TCSLD)OXDEMO: Includes Al, C, Ca, Fe, O, S, and Si (a subset of TCOX)SUBDEMO: Includes C, H, Fe, and O (subset of SSUB)PAQ2: Public Aqueous Solutions Database: Includes: H, Na, Cr, Fe, Co, Ni, C, N, O, S, and ClPG35: G35 Binary Semi-Conductors: Includes: Al, Ga, In, P, As, and SbPURE5: Includes critically assessed unary thermochemical data for the concerned elements. The PURE5 database is only intended for extracting data for the pure elements when performing assessment work, or for tabulating or plotting thermodynamic properties of the pure elements.Mobility Demo Databases:MALDEMO: Includes Al, Cu Si, Sc, and Zr (subset of MOBAL)MFEDEMO: Includes Fe, Cr, Mn, Ni, and C (subset of MOBFE)MNIDEMO: Includes Ni, Cr, and Al (subset of MOBNI)MCUDEMO: Includes Cu, Ti, and Zr (subset of MOBCU) Textbook with Exercises (and Solutions)

2025-04-01Unexpected expenses can throw your household budget into chaos. Need to replace a damaged front tire on your car? Maybe you’re facing an unexpected medical bill. Or maybe your laptop just conked out. Whatever the reason, you need fast access to cash. Current Paycheck Advance might be a solution. Online bank and financial technology company Current offers a paycheck advance feature that allows you to receive a cash advance from your next paycheck if you need quick access to emergency funds. Instead of waiting until your next payday, you can get the cash you need now. But is a Current Paycheck Advance a smart financial move? That depends on how quickly you need the funds to cover unexpected expenses. While Current’s basic paycheck advance comes with no fees, the company does charge an Instant Access fee if you want an instant direct deposit of cash in your bank account. If you don’t choose Instant Access, Current will deposit your money into your bank account within three business days. But by waiting, you won’t be charged any fees. Should you consider a Current Paycheck Advance if you are short of funds? Read our review to find out. What is Current Paycheck Advance? How does Current Paycheck Advance work? How much does a Current Paycheck Advance cost? Features of a Current Paycheck Advance No fees (mostly) Overdraft protection Cash back Savings pods Who should consider a Current Paycheck Advance? Those who don’t want to pay Those willing to pay a small fee for quick cash Those willing to open a Current account Those with weaker credit scores Who should not use a Current Paycheck Advance? Those who need a large sum of money Those who don’t receive regular direct deposits from their employer Those who want to focus on budgeting, building an emergency fund Pros and cons of a Current Paycheck Advance How Current Paycheck Advance compares to the competitors Dave Empower Earnin Chime FAQs The bottom lineWhat is Current Paycheck Advance? Current is an online bank that you can access by downloading its app from the App Store or Google Play.

2025-04-10You might not qualify for that full amount. Current will look at your eligible payroll deposits before deciding upon your advance amount.Repayment of your paycheck advance is simple, too. Current will simply repay your advance amount by removing the appropriate amount from your next paycheck. This, of course, is the big negative with any paycheck advance. By taking one out, your next paycheck will be lower. This could lead to cashflow issues before your next payday arrives. That’s why it’s always best to build an emergency fund containing up to six months of daily living expenses. That way, if you face an unexpected financial emergency you can cover it with your savings instead of having to apply for paycheck advances or resort to covering these financial emergencies with your credit card. You can take out as many paycheck advances as you’d like with Current. Although if you find yourself constantly applying for cash advances before your next pay period arrives, you should look at your spending habits. You might also focus on your budgeting to make you aren’t overspending each month. You don’t want to rely too heavily on paycheck advances.How much does a Current Paycheck Advance cost? Unlike with many other cash advance apps, a basic paycheck advance from Current is free. You won’t have to worry about making a late payment, either. That’s because Current automatically withdraws your repayment from your next paycheck. If you want to receive your paycheck instantly, though, you will have to pay a fee. Current does not list the amount of this fee but does say the size of it will depend on how large of a cash advance you request. Current will show your fee when you apply for instant access of your cash. If you think the fee is fair, you can proceed. If you don’t, you can cancel your paycheck advance request or schedule a free version of your request.Features of a Current Paycheck AdvanceNo fees (mostly)The biggest draw of a Current paycheck advance is that you won’t pay a fee for it, if you can wait up to three

2025-04-22